Top 10 payment gateway providers for online businesses

Online payment is an integral feature that every e-commerce website must-have.

This feature can be integrated into your business website with the help of a payment gateway.

A payment gateway facilitates businesses to handle electronic payments.

They enable online payments through credit cards, debit cards, or any other form of e-payment such as net banking or UPI.

It is an application that connects your business website to a customer’s bank account.

It acts as a third party that securely conducts online transactions by transferring money from the customer’s account to the merchant’s payment portal.

Considering the fact that highly sensitive information is transferred through a payment gateway, it is imperative that the gateway you are using is extremely safe and secure.

Along with the security, while a selection of a payment gateway the size and operational size of your business should also be taken into consideration.

We have listed down Top10 payment gateway providers for online businesses, along with their features, which you can go for as per your business needs.

- Paypal

- Razor Pay

- Stripe

- CC Avenue

- Instamojo

- PayU

- Brain Tree

- Chargebee

- Cashfree

- MobiKwik

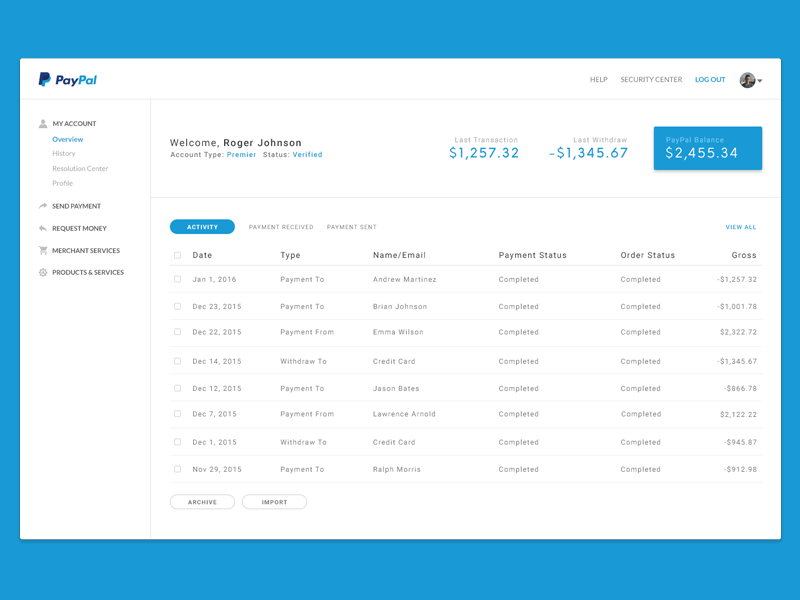

1. Paypal

Paypal is one of the most popular and first choices for most businesses which involve a large number of international payments. It is available in more than 200 markets in the world and supports payments in more than 100 currencies.

Pros:

- Easy to set up

- Can make payments without exposing credit card details.

- Supports multicurrency.

- No maintenance fees.

- Can create and send invoices through the account itself.

- Easy to set up

Cons:

- Not available in all the countries.

- High transaction fee.

- Poor customer service

- Not available in all the countries.

Charges:

- Maintenance fee= zero

- Transaction fee per transaction: 4.4% + US$0.30 + Currency conversions charges

- Maintenance fee= zero

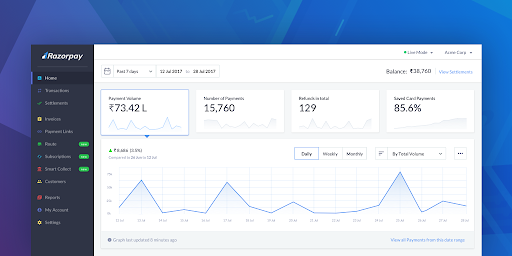

2. Razorpay

Razor Pay is another sought after payment gateway. This unicorn startup founded in 2013 has a $1B valuation with over $200M funding to date. Having provided 8,00,000+ businesses with a digital payment gateway, Razorpay supports various payment methods such as credit and debit cards, net banking, wallets, and UPI.

Pros:

- Supports international credit card and payment.

- Zero withdrawal fee.

- Integrated Merchant account.

- 24/7 customer support

- Supports international credit card and payment.

Cons:

- The high failure rate for international transactions.

- Transaction rates comparatively high.

- Though customer support is 24/7 not all the time there is live support. Need to depend on the chatbot and IVR.

- The high failure rate for international transactions.

Charges:

- Annual maintenance charge & setup fee is zero.

- Transaction fee per transaction= 2% + 18% GST on the transaction fee

- +1% on international cards, EMI and AMEX

- Annual maintenance charge & setup fee is zero.

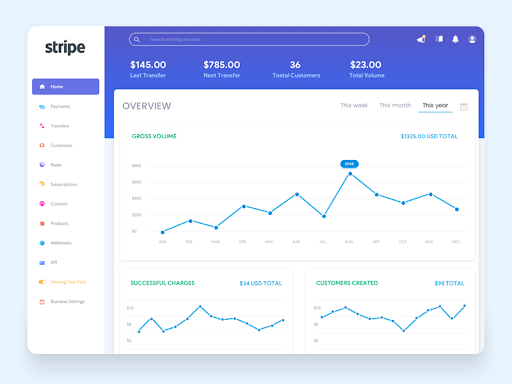

3. Stripe

Stripe is a robust cloud payment gateway platform that along with processing payments also provides great security. Its open API helps you in easily integrating it with your preferred business software application. Some of the features which it offers are a custom UI toolkit, consolidated reports, embedded checkout, and many more.

Pros:

- Easily manageable using their dashboard.

- Can be integrated with numerous e-commerce solutions.

- Accepts various cards and digital wallets along with international currencies.

- Easily manageable using their dashboard.

Cons:

- Integrating stripe can be intimidating for the non-programmers.

- Does not provide live support. In case of any issues, you need to mail the company.

- Integrating stripe can be intimidating for the non-programmers.

Charges:

- No setup fee

- Transaction fee per transaction: 2% for cards issued in India, 3% for cards issued outside of India.

- No setup fee

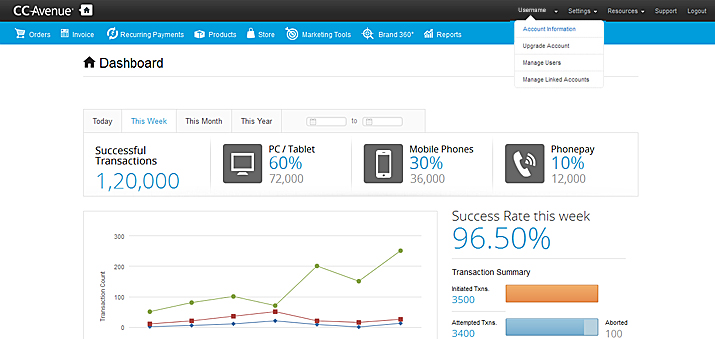

4. CC Avenue

It is one of the oldest payment gateways around and supports more than 200 payment options. CCAvenue facilitates online payment through credit cards, debit cards, e-wallets, net banking, and also cash card methods. Along with multiple payment options, it also provides you with the features such as payment analytics, electronic check processing, multiple bank connections, and a card storage vault.

Pros:

- Supports multiple currencies

- Supports EMI as payments

- Supports multiple currencies

Cons:

- Sometimes payments hold to continue for a long time.

- Not efficient customer supports

- Sometimes payments hold to continue for a long time.

Charge:

It provide with two plans for its customers as of now:

- Startup pro: zero setup fee, transaction fee: 0.20% – 0.50% + GST per day

- Privelege: 30,000 setup fee, transaction fee: 0.20% – 0.50% + GST per day.

- Startup pro: zero setup fee, transaction fee: 0.20% – 0.50% + GST per day

A detailed price list can be seen here.

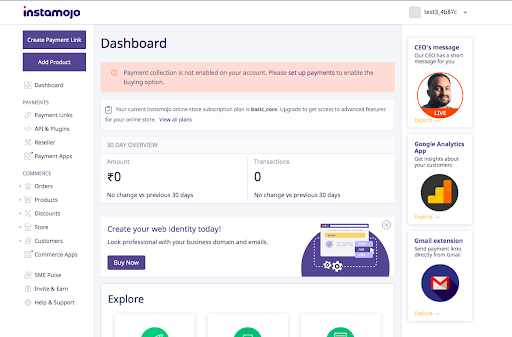

5. Instamojo

Instamojo is one of the largest multi-payment networks in the country supporting around 2, 20,000 small businesses. This gateway can be set up with or without any website and will hardly take any time to create a merchant account. Some of its key features are simple APIs, no annual maintenance fee, a free online store & payment completion using the link on any of your social media platforms, also Whatsapp and SMS.

Pros:

- Supports all major e-commerce CMS Systems.

- Live customer support available.

- Does not require a website to support online transactions

- Supports all major e-commerce CMS Systems.

Cons:

- Does not support international payment, credit card, and multi-currency.

- Customer support not available during the weekends

- Does not support international payment, credit card, and multi-currency.

Charges

- Zero annual maintenance charge

- Transaction fee per transaction : 2% + Rs 3 per transaction.

- Zero annual maintenance charge

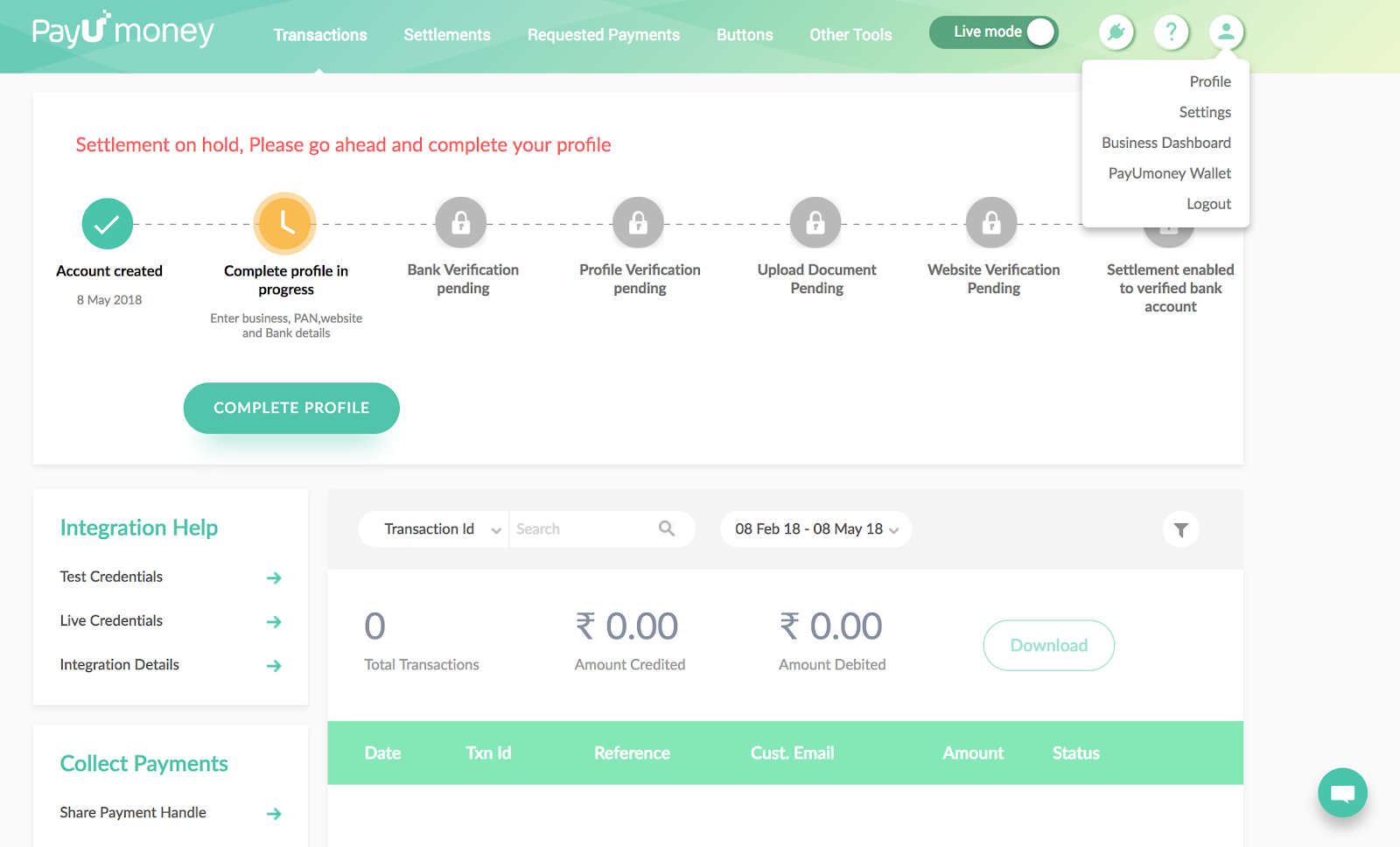

6. PayU

With a great conversion rate of 12%, PayU is one of India’s largest payment gateways. It has payment methods that are designed to make online payments faster and secure. PayU has a presence in 16 high growth markets in Asia, Latin America, Africa, Central, and Eastern Europe, and Africa. Some of its best features are Multi-currency, web checkout tokenization, express payment, and recurring payment.

Pros:

- Subscription APIs can be integrated easily with your website.

- International Payments

- Same day settlements

- Payouts to disburse bulk payments instantly.

- Subscription APIs can be integrated easily with your website.

Cons:

- As payments are disbursed on a bulk basis weekly, some businesses may face problems with cash flow.

Charges:

- Zero setup and annual maintenance charge.

- Transaction fee per transaction : 2%, AMEX: 3%

- Zero setup and annual maintenance charge.

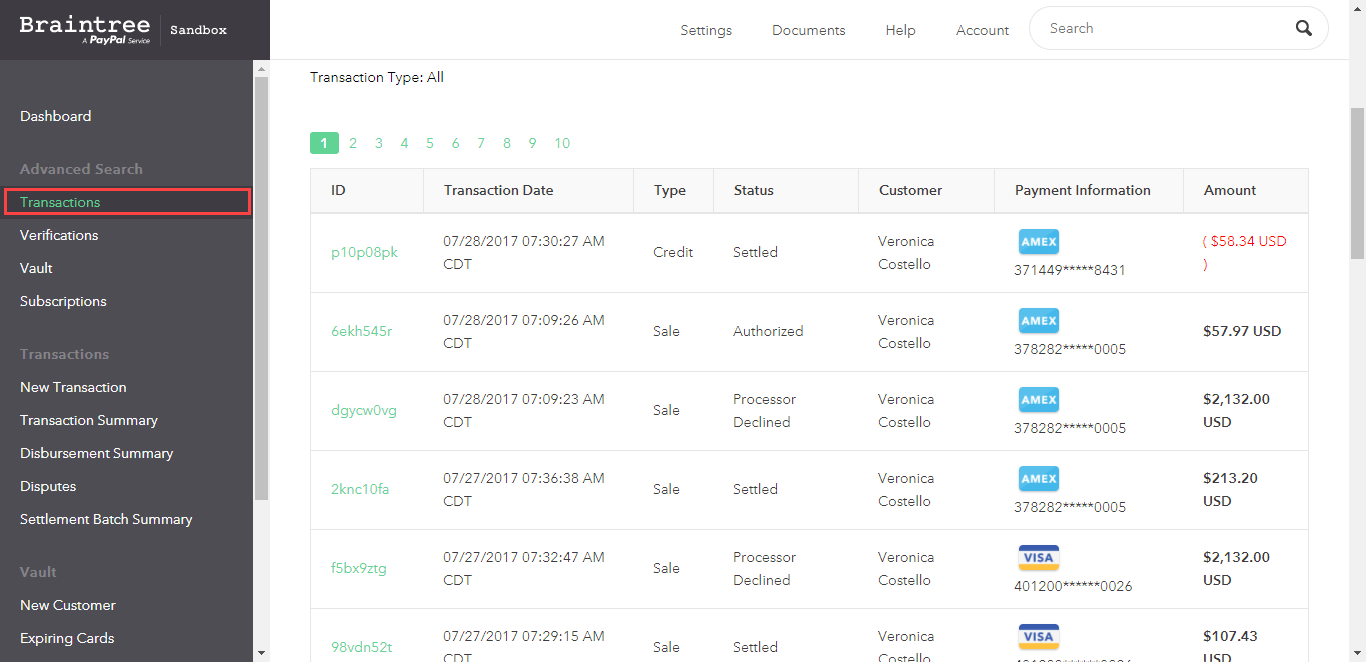

7. BrainTree

Brain Tree, acquired by Pay Pal is one of the largest payment processors in the world. This payment gateway offers various features that provide a seamless checkout experience for the user. Along with customization options, this gateway also provided you with a true data portability feature, which means that you can easily transfer your customer database information in case you switch to a different provider anytime.

Pros:

- Multicurrency feature

- Extensive integrations

- Customization options

- Comprehensive payment type support

- Multicurrency feature

Cons:

- High price

- Long setup time

- Various complaints of closed accounts and frozen funds

- High price

Charge:

- Zero setup and annual maintenance charge

- Transaction fee per transaction : 2.9% + $0.30 per transaction

- Zero setup and annual maintenance charge

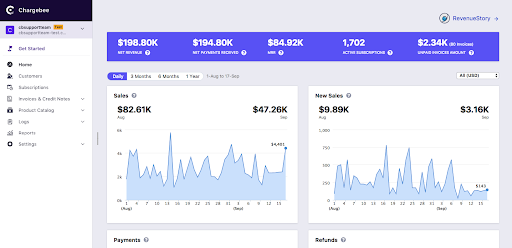

8. Chargebee

Chargebee makes it extremely convenient to deliver an accurate recurring billing experience. It is very easy to integrate and make it easier for the user to pay via any payment method. One of its main features is it takes away your pain of subscription billing.

Pros:

- Easy to set up

- Customer support is good and fast

- Extremely helpful in recurring billing

- Easy to set up

Cons:

- Difficult to handle multiple invoices at once

- The dashboard is not that robust.

- Difficult to handle multiple invoices at once

Charges:

- $249 billed annually which includes $600K/year revenue. 0.6% of overage revenue(overage is charged on monthly revenue, once the annual revenue limit is met.

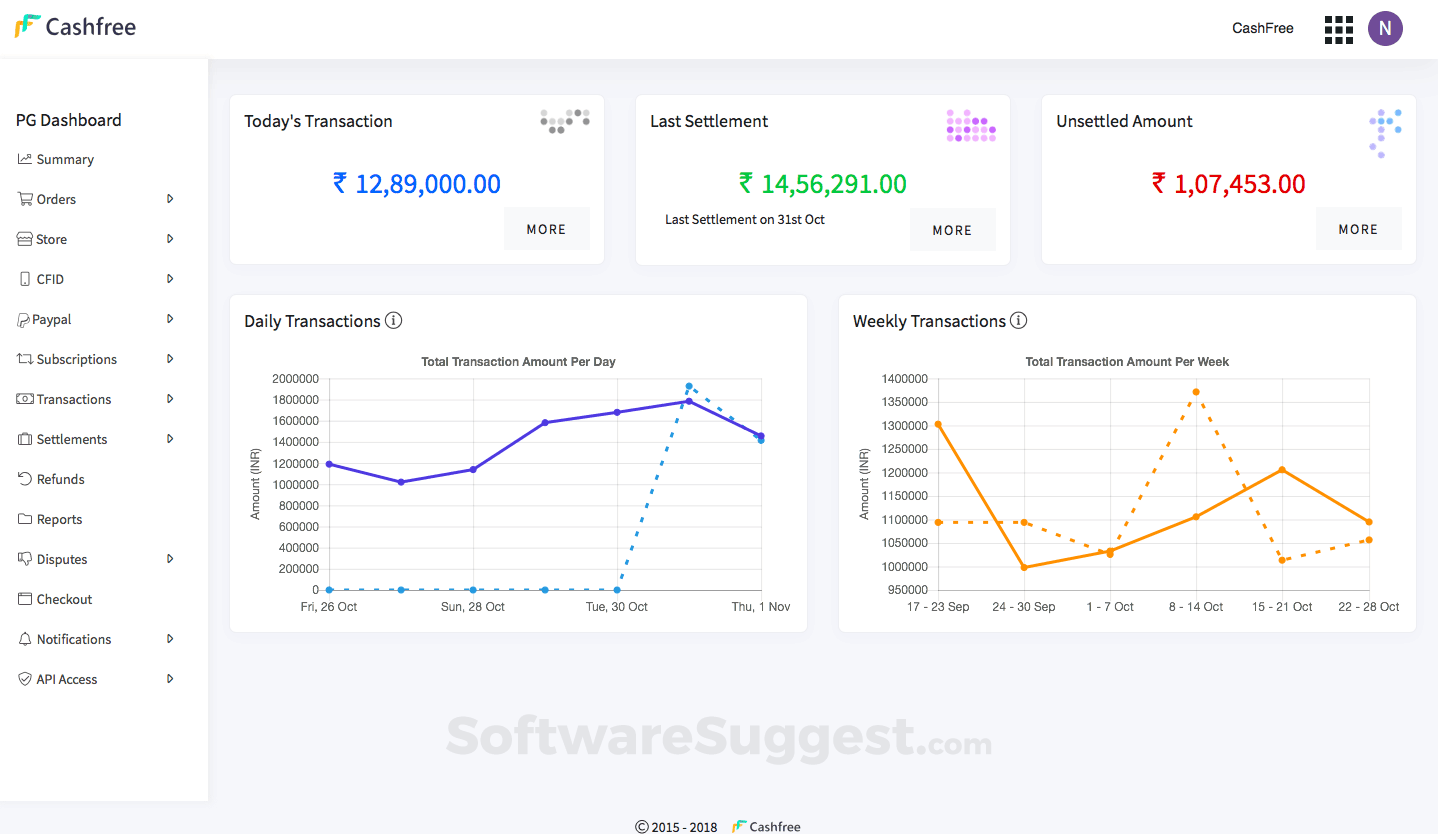

9. Cashfree

Used by 50,000+ businesses, Cashfree is a full-stack payments solution. This easy to integrate payment gateway supports vendor payouts, wage payouts, bulk, and instant refunds. Cashfree also facilitates a split payment solution for your business, consisting of a bank account verification API and a virtual account called auto collect which does the inbound payments to customers.

Pros:

- Accepts international payments

- Supports pay later and EMI options

- Facilitates recurring billing and multi-currency

- Accepts international payments

Cons:

- Customer onboarding takes time

- Though an account manager is assigned for each account, customer support can be contacted only on weekdays.

- Customer onboarding takes time

Charges:

- Zero setup and annual maintenance charge

- Transaction fee per transaction :

- -1.75% on Visa, Mastercard, Maestro Rupay, Google pay, UPI, Amazon Pay, PhonePe, Icici, Netbanking.

- -2.5% on pay later and cardless EMI

- -3.5% +7 on International Cards

- Zero setup and annual maintenance charge

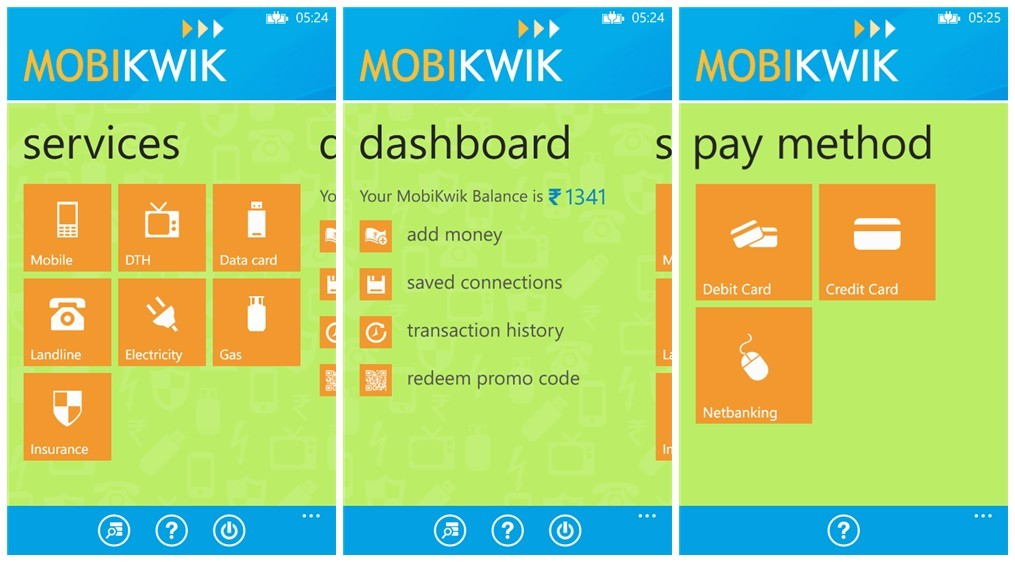

10. MobiKwik

MobiKwik is a payment gateway, as well as a digital wallet offering solutions to both individual users as well as business firms. It is a very easy process to set up and integrate this gateway. A popular payment gateway in India where merchants & business owners can set up their accounts in 2-5 business days. MobiKwik can be accessed even on android, iOS, and Windows devices. It provided seamless integration along with diverse payment options and a high rate of successful completion of transaction paths.

Pros:

- Supports all Indian and International cards

- Can accept payments from your customers in your wallet

- Supports all Indian and International cards

Cons:

- Does not support multi-currency

- Does not provide API

- Does not support multi-currency

Charges:

- Custom setup and annual maintenance charge

- Transaction fee per transaction: 1.9%

- Custom setup and annual maintenance charge

Sylvester Pertsovsky

Absolutely composed written content , appreciate it for entropy. Sylvester Pertsovsky

sikis izle

Really appreciate you sharing this post. Thanks Again. Cool. Earl Sheilds